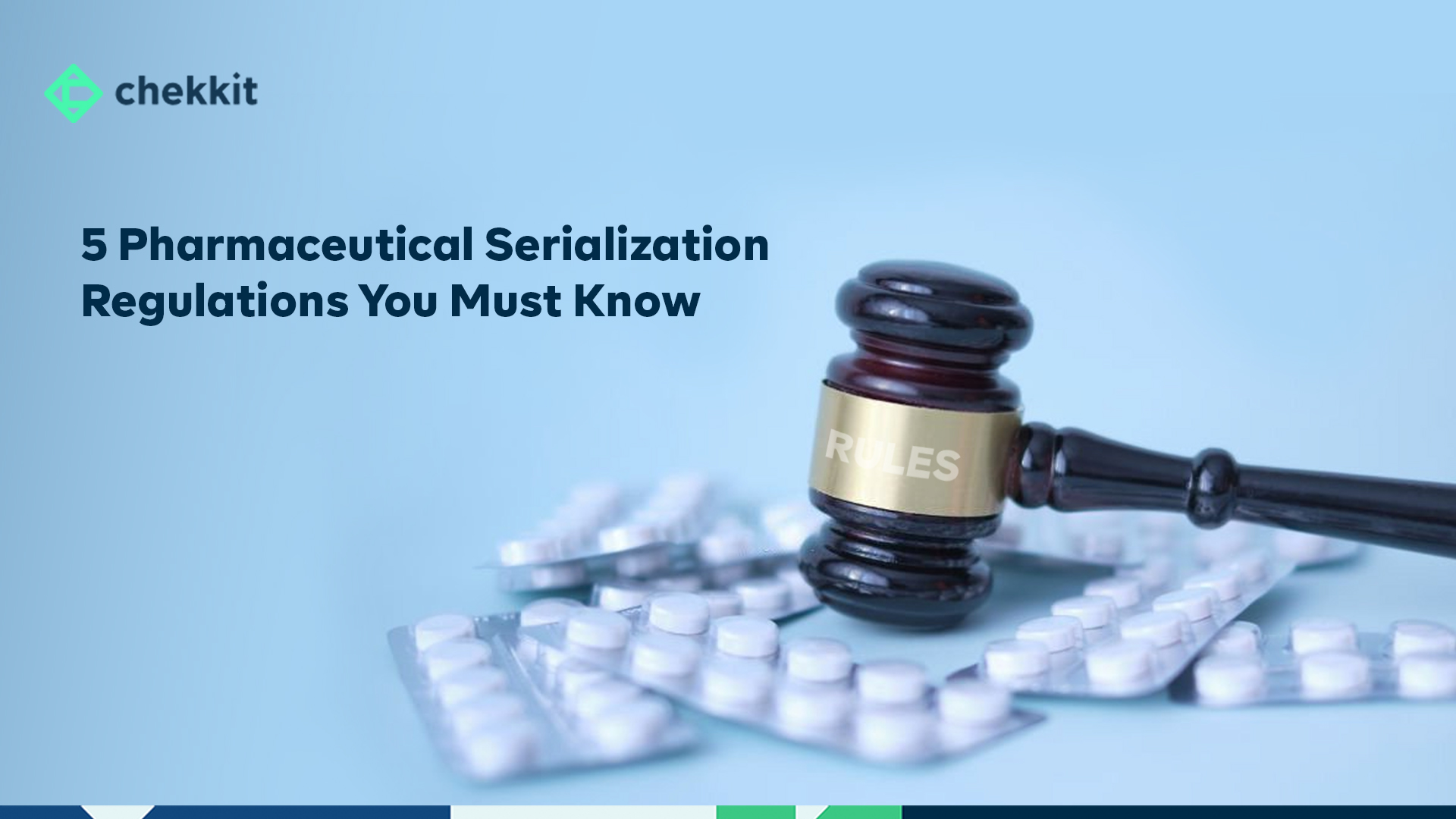

Are you curious about the regulations surrounding drug supply chains across the world? Look no further! From the DSCSA in the US to the FMD regulation in Europe, and the Chinese Pharma Regulatory Requirements, this article provides an overview of serialization and traceability requirements for drug supply chains across different parts of the world.

Pharmaceutical Serialization Regulations From Across The World

Although regulations vary across different countries, the common goal is to prevent counterfeit drugs from entering the legal supply chain and ensure patient safety. So, grab your popcorn, sit back and enjoy this regulatory rollercoaster ride, which promises to leave you informed and prepared to enter new markets.

1. The DSCSA Regulation in the USA

The Drug Supply Chain Security Act (DSCSA) of the United States has laid down specific serialization and track and trace requirements for the drug supply chain. These requirements apply to all the stakeholders involved in the supply chain, from the manufacturer to the dispensers.

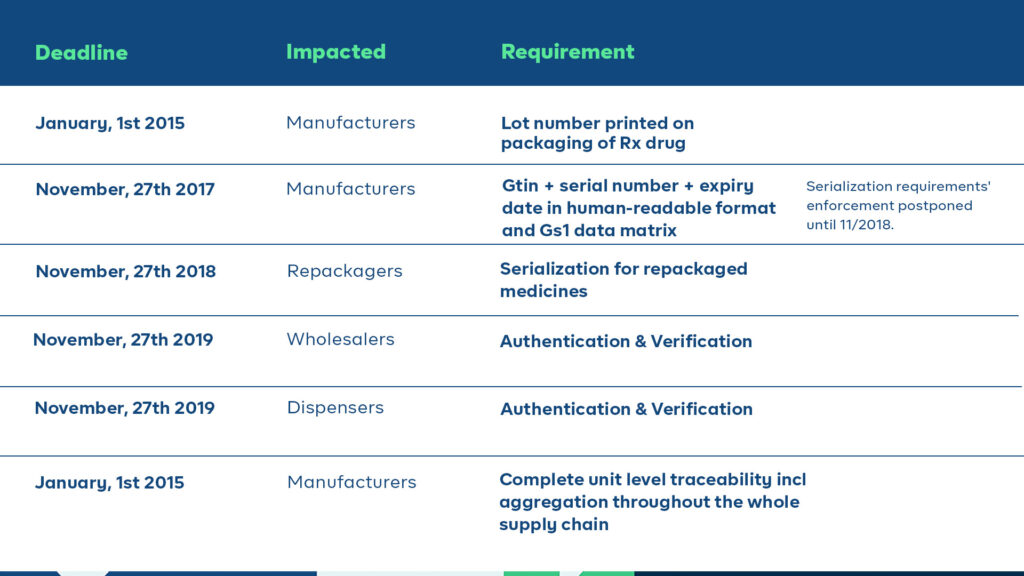

One of the initial deadlines of the DSCSA was in January 2015, which mandated the printing of lot numbers on the packaging of all prescription drugs. Additionally, supply chain partners were required to exchange 3T documents (transaction information, transaction history, and a transaction statement) at every transfer of liability. Pharmacies had to comply with these regulations by capturing and maintaining the 3T documentation for six years.

The plan was that starting from November 2017, all prescription drugs in homogenous cases must be serialized and compliant with the FDA’s SNI guidance. However, due to a lack of qualified vendors and industry readiness, the enforcement of DSCSA serialization requirements was postponed for a year and kicked off in 2018. Stakeholders in the supply chain must comply with these requirements by specific deadlines, with full unit-level traceability becoming mandatory by 2023.

Additionally, the DSCSA directs FDA to establish national licensure standards for wholesale distributors and third-party logistics providers, and requires these entities to report licensure and other information to the FDA annually.

2. The FMD Regulation in Europe

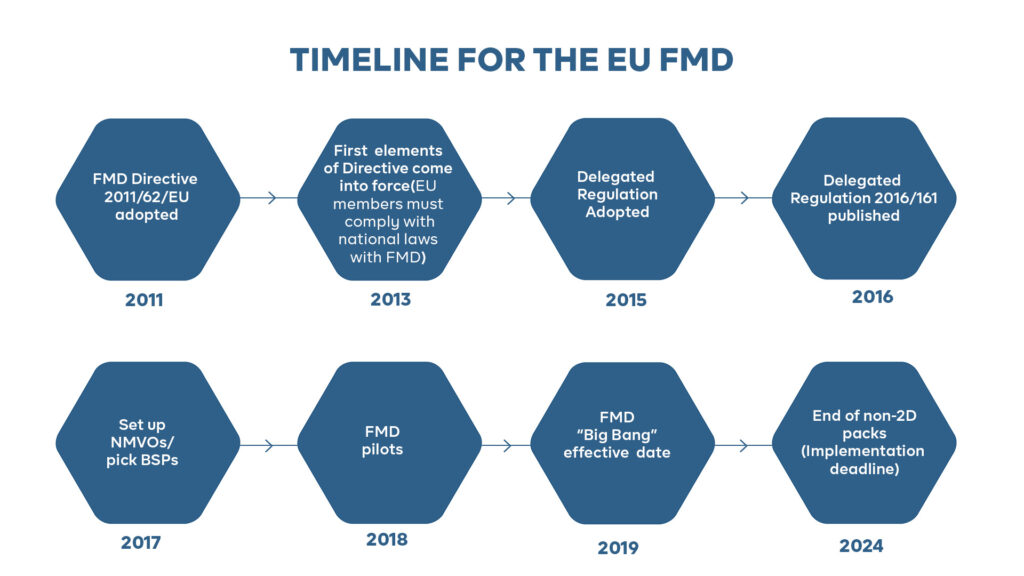

The Falsified Medicines Directive (FMD) is a European Union (EU) regulation that aims to prevent the entry of falsified medicines into the legal supply chain. It was implemented on February 9, 2019, and applies to all member states of the EU and the European Economic Area (EEA).

The FMD regulation applies to all prescription medicines that are produced, imported, or distributed in the EU and the EEA. This includes medicines that are manufactured outside of the EU but are intended for sale in the region. The regulation does not apply to over-the-counter (OTC) medicines, medical devices, or veterinary products.

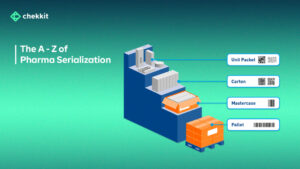

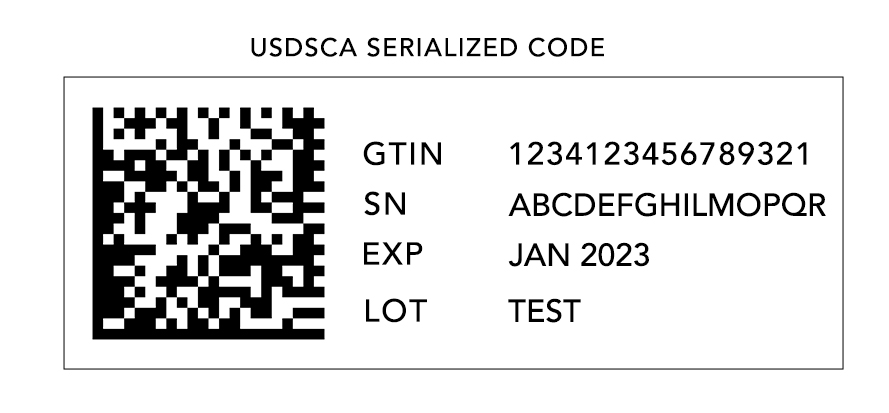

The FMD regulation requires manufacturers, wholesalers, and other stakeholders in the pharmaceutical supply chain to serialize and authenticate all prescription medicines. Manufacturers are required to ensure that each individual package of medicine has a unique identification code that can be used for serialization and authentication. The identification code must be tamper-evident and must be printed in a human-readable format as well as in a machine-readable format (such as a barcode or a data matrix).

Manufacturers are also required to upload information about each individual package of medicine to the EU hub. The EU hub is a central database that allows for the verification and authentication of medicines throughout the supply chain. The information that must be uploaded includes the unique identification code, the name of the medicine, the batch number, the expiration date, and the manufacturer’s name.

Manufacturers must also ensure that they have an effective system in place to detect and investigate suspected falsified medicines. This includes reporting any suspected falsified medicines to the competent authorities within 24 hours of detection. Failure to comply with the FMD regulation can result in significant penalties

3. The Chinese Pharma Regulatory Requirements

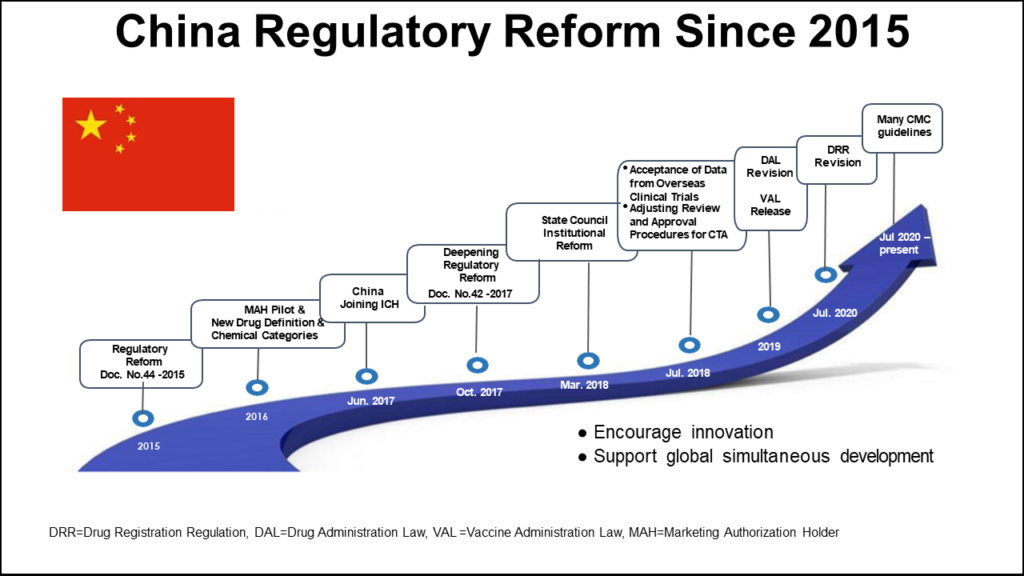

China has one of the largest pharmaceutical markets in the world, generating nearly $35 billion in pharmaceutical imports in 2020, and the trend is upward. The Chinese National Medical Products Administration (NMPA) is responsible for overseeing compliance with these regulations. Sadly, the NMPA doesn’t make its documents available in English which can be a problem for many manufacturers looking to enter the market.

Serialization guidelines were first introduced in 2013 but in 2016, this initial effort toward traceability was halted. The original serialization initiative in China aimed to assign a 20-digit serial number to all domestically sold products, covering individual, bundle, box, and pallet levels. However, the serial number was assigned by the government, and the data had to be manually uploaded to a platform only accessible within China. Additionally, the code used did not comply with the GS1 standard, which is the norm in all other global serialization mandates. Owing to numerous challenges, the plan was abandoned, and a new draft was developed.

From 2022, there are two different serialization procedures allowed, and the government is no longer the issuer of serial numbers. Instead, manufacturers and pharmaceutical serialization providers must comply with a new concept for serial number assignment. This code can be assigned not only by GS1 but also by other issuing bodies that adhere to the relevant ISO. Thus, the responsibility for creating a traceability system is placed on the manufacturers.

As in other regions, the product identification code on a Chinese package must be machine and human-readable. Throughout the supply chain, traceability information must be exchanged among trading partners, reported into the government system, and retained for at least five years. Prior to commencing serialization activities, the Marketing Authorization Holder (MAH) must report its serial number generation plan and disclose the entity responsible for generating the codes if it is not self-generated.

4. NAFDAC Traceability Strategy in Nigeria

The Federal Ministry of Health and the National Agency for Food and Drug Administration and Control (NAFDAC) have collaborated with private and public sector partners to create a traceability system for the pharmaceutical industry. The goal of this system is to ensure that the pharmaceutical industry in Nigeria adheres to global standards and provides visibility of product status from the manufacturing plant to the end patient.

The traceability system will follow a verification model in its first phase. This model refers to checking at a single point in the supply chain that the identification data held in the barcode is assigned by the manufacturer of the product. In this phase, only the primary or secondary package might be required to carry a unique code, and consumers and supply chain stakeholders can verify the codes to see information about the product.

In the second phase, the system will follow a track-and-trace model. This model supports the capture of data from trading partners as the product moves through the supply chain, from the manufacturer to the end-user. This will require serialization across all sellable packaging levels and the easy sharing of data across supply chain stakeholders.

By 2024, the regulation kicks in fully. You can find more details in our comprehensive article on the Nigerian traceability regulations and how you can get compliant.

5. Traceability & Serialization Regulation in India

India’s pharmaceutical industry has been grappling with significant regulatory changes in recent years, including new track and trace requirements aimed at combating counterfeiting, diversion, and unauthorized sales. The Ministry of Health has extended deadlines and released new draft rules in key areas of the country’s pharmaceutical regulations.

Beginning January 1, 2023, all imported and domestically manufactured APIs must be labeled with QR codes at each level of packaging to store data or information. This process began in June 2019, when the Drugs Technical Advisory Board (DTAB) approved a proposal mandating QR codes on APIs, estimating that the regulation would affect approximately 2,500 APIs. The QR codes must contain eleven data points, including unique product identification codes, batch numbers, and manufacturing license numbers or import license numbers.

On April 4, 2022, the Directorate General of Foreign Trade (DGFT) released a public notice extending the deadline for export reporting to the Integrated Validation of Exports of Drugs from India and its Authentication (iVEDA) portal to March 31, 2023. This requirement has been postponed at least four times, starting in 2018, when India’s track and trace requirements centered around another reporting portal, the Drugs Authentication and Verification Application (DAVA).

Finally, the Ministry of Health and Family Welfare published draft guidelines for barcoding the Top 300 brands in the country, all of which are named in “Schedule H2” of the announcement. The rules will come into force on May 1, 2023. These guidelines stipulate that eight data points must be incorporated into a “Bar Code or Quick Response Code” to be printed on or affixed to the primary packaging. The eight data points include unique product identification codes, proper and generic drug names, and manufacturing license numbers. If there is inadequate space on the primary package label, the codes must be placed on the secondary packaging.

There have been concerns about the practicality of QR codes for data-dense pharmaceutical labeling and whether the guidelines will actually help fight counterfeiting, diversion, and unauthorized sales. Industry observers have also noted that the eight mandated data points would require labels that would be unrealistically large, making them too big to fit on most packages.

Without a doubt, the global pharmaceutical industry is rapidly evolving in terms of serialization and traceability requirements in different regions of the world. The implementation of serialization guidelines aims to prevent counterfeit drugs from entering the legal supply chain and ensure patient safety. While these regulations are good, we must ensure that all stakeholders involved in the supply chain, from the manufacturer to the dispensers, comply with these regulations by the specified deadlines. Noncompliance will lead to significant penalties and may even stop you from doing business in certain regions.

If you’re interested in knowing how our pharma serialization and traceability software for manufacturing works, we will be more than happy to walk you through our technology.

As a pharmaceutical manufacturer, this technology will help you stay ahead of the curve and ensure that you can spot new market opportunities long before the competition.